Unemployment Insurance

Unemployment Insurance program summary

The Department of Labor & Industrial Relations houses the Unemployment Insurance (U.I.) program, which provides qualified unemployed workers temporary financial assistance. The main benefit is receiving a weekly benefit amount that comes from the Unemployment Trust Fund. Workers do not pay taxes and receive no deductions in pay when they are in the U.I. program.

Unemployment Insurance Program

Phone number: (808) 586-8970

Email: dlir.ui.oahu@hawaii.gov

Who qualifies?

Unemployed workers/workers put in reduced hours

Has previously been under employment for the last 18 months

Has been seeking employment weekly

Legally authorized to work in the United States

Able to work as soon as possible when offered employment

Has been paid during two quarters of base period and have been paid wages around 26 times the weekly benefit amount

Required documents

Social Security Number

Employment information from the past 18 months (date of employment, employer’s name and address, reason for leaving)

Bank information

Employment authorized documents (if not a U.S. resident)

Online Resume (to be accessed in the HireNet Hawaii website)

Filing claims procedure

Filing claims ONLINE ONLY: https://huiclaims.hawaii.gov

Languages available for filing online: English, Simple Chinese, Tagalog, or Japanese

Free interpretation services provided upon request

Client has to proceed to “File a Claim Online”

Client has to provide an email address to create an account before continuing on with the filing process

Check email for temporary password, then create a new password when logging in

When filing, client has to report total earnings – before taxes – which will then be deducted from the weekly benefit amount

Clients need to file for the first two weeks after starting the program, then they will be able to file on a bi-weekly basis

Clients are expected to receive benefits about three weeks after filing initial claim

Next file period schedule will be available online

Clients will not be able to edit initial claim after submitting it

Once a client finds a full-time position, they can stop filing claims

Requirements for work/job registration (HireNet Hawaii)

Those who are eligible are required to upload an online resume (lasts on website for 12 months) within a seven-day period right after filing the claim through https://www.hirenethawaii.com/vosnet/Default.aspx

New users to the site has to register for a new account before setting up their online resume

Need to provide a minimum of three job contacts per week w/contact information

Those in an approved union must follow the union’s rules for work/job registration instead of using HireNet

Update/create new online resume before the 12-month timeline, if need be, or else benefits will be discontinued

Maximum weekly benefits amount

Those eligible will earn the maximum benefits for 26 weeks. The maximum weekly benefit amount is $695 for filed claims.

After a client files a claim, it will be effective on Sunday during the week of initial claim.

Client will not be able to receive U.I. benefits if they travel as the program requires to be able to work right away as soon as possible.

Benefits from working part-time/on-call

Clients can be able to receive up to $150 without repercussions, except deductions from weekly benefit amount if earnings are above the capped amount. No benefits if their earnings are equivalent/greater than weekly benefit amount. Unemployed benefits count as taxable income.

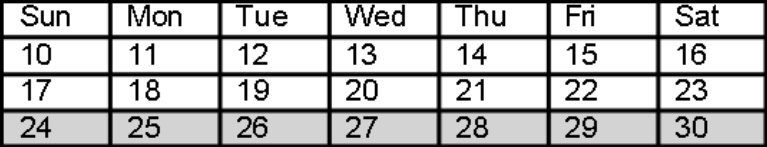

Filing Bi-weekly example

August 10th – 30th

A week for filing a claim means a calendar week that starts on a Sunday and ends on a Saturday.

Whenever a client files for a bi-weekly period, make sure they file each week separately. Start with the first week, then go on to the second week. In this example, the first two rows are week 1 and week 2. The third row that is shaded is the bi-weekly filing period where clients must file bi-weekly for week 1 and week 2 within seven days. Clients must file for both weeks in order to get paid for those two weeks.